Republicans target a tax that keeps state Medicaid programs running

Published in Political News

The tax and spending bill the U.S. House approved last week targets a strategy states have used to boost the Medicaid dollars they get from the federal government. The measure would cap or freeze the taxes states levy on medical providers, potentially leaving states with major holes in their Medicaid budgets.

As a result, states would face the choice of either replacing the lost federal money with state dollars, scaling back services or providing coverage to fewer people.

Medicaid is a joint state-federal program, primarily for people with low incomes. For the traditional Medicaid population — children and their caregivers, people with disabilities and pregnant women — the federal government matches state Medicaid spending on a sliding scale, ranging from 50% for the wealthiest states to 77% for the poorest ones.

Consider a state that gets half of its Medicaid funding from the federal government. If that state collects $100 million by taxing providers, it can use $50 million of the revenue to draw down $50 million in federal matching funds, which it can use to expand Medicaid coverage to more people. Then it can take the remaining $50 million in revenue and use that money to draw down $50 million in federal dollars to pay providers more for caring for Medicaid patients.

Forty-nine states — all but Alaska — use the strategy. In 2018, the most recent year for which data is available, states relied on provider taxes to fund 17% of their Medicaid spending, up from 7% in 2008, according to the U.S. Government Accountability Office.

As part of their effort to cut federal Medicaid spending by roughly $625 billion over the next decade, House Republicans have proposed capping the state provider taxes and freezing them in place, preventing states from raising them or implementing new ones in response to inflation. Under current law, states can levy taxes of up to 6% on tax providers’ net revenue. The GOP measure also would add work requirements for Medicaid recipients, a step that would save money by reducing the rolls.

A report from the Congressional Budget Office, the bipartisan research arm of Congress, says eliminating the taxes entirely could save the federal government hundreds of billions of dollars over the next decade.

Many conservatives say the taxes are an accounting trick that allows states to draw down money from the federal government without having to front their true share of the Medicaid program. Some have even called the provider taxes a “ money laundering” scheme.

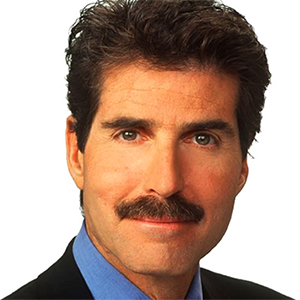

“States are gaming the system — creating complex tax schemes that shift their responsibility to invest in Medicaid and rob federal taxpayers,” Dr. Mehmet Oz, the administrator of the federal Centers for Medicare & Medicaid Services, said in a May 12 news release.

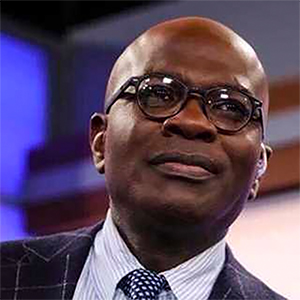

Brian Blase, president of the Paragon Health Institute, a conservative policy group that is working with Republicans to formulate Medicaid cuts, described provider taxes as “a way that states and providers can rip off the federal government.”

“States need to have some accountability for the spending in their programs,” Blase said.

But advocates of these taxes, including state Medicaid directors and even the hospitals that pay the taxes, describe them as legal and legitimate financial tools that have helped providers cover essential services and states fund their Medicaid programs for years. The result of eliminating these taxes or freezing them, they say, will be hospital closures and service cuts.

“We don’t like to pay these taxes, but the alternative is resources or access to care aren’t there for that community,” said Jason Pray, vice president of legislative affairs at America’s Essential Hospitals, an association representing about 350 hospitals. “The state would more than likely have to then tax individuals to make up for that, to keep the services at the same level and keep the resources at the same level.”

Blase said the provider taxes allow hospitals to make windfall profits from the additional federal matching funds that flow back to them, representing a type of “corporate welfare.”

But Pray said often hospitals in his association are losing money. By allowing states to boost payments to hospitals and other providers that serve Medicaid patients, he said, the tax enables hospitals to stay open in the long run, not garner a windfall.

Pray also noted that in the past, support for the taxes has been bipartisan.

“Republicans for years have shown they support provider taxes and have understood the value of them,” he said.

Edwin Park, a research professor at the Georgetown University McCourt School of Public Policy, pointed out that some hospitals pay the tax and don’t get much back, because they serve few Medicaid patients. The hospitals that benefit most are the so-called safety net hospitals that do care for many low-income patients, he said.

Park said he is worried that once the strategy is off the table, states will have to cut their Medicaid spending to balance their budgets.

Jay Ludlam, deputy secretary for North Carolina Medicaid, is worried about that, too. In North Carolina, Ludlam said, almost all of the tax revenue the state collects from providers helps pay for Medicaid services.

“The money goes to providers when they provide services. It’s not special. It’s just another way that states tax themselves and put money into the program,” Ludlam told Stateline. “If it means that there’s going to be less money in Medicaid … we’ll have to cut eligibility, cut benefits, cut provider rates, in order to maintain the program.”

____

Stateline reporter Shalina Chatlani can be reached at schatlani@stateline.org.

©2025 States Newsroom. Visit at stateline.org. Distributed by Tribune Content Agency, LLC.

Comments