Trump memecoin uproar complicates crypto-backed stablecoin deal

Published in Political News

WASHINGTON — The controversy over President Donald Trump’s crypto profits is threatening to derail a quick deal on bipartisan stablecoin legislation backed by both the crypto industry and the White House.

Elizabeth Warren, the top Democrat on the Senate Banking Committee, is leading the effort to use the stablecoin bill to bar a sitting U.S. president from profiting off crypto ventures, which have already earned Trump and his family millions.

Democrats in talks with Republicans have pushed to include legislation barring the president from profiting off of his memecoin and other cryptocurrencies, said a Senate Democratic aide familiar with the discussions.

Progress has been made in the talks but policy discussions are still ongoing, the aide added.

Democratic leadership, meanwhile, also wants changes to language dealing with Tether, the leading stablecoin, as well as language addressing Trump, said another person familiar with the discussions.

Minority Leader Chuck Schumer has signed on to separate legislation to ban Trump from profiting from his crypto projects.

But Warren’s push to include it on the stablecoin bill puts Schumer in a familiar bind of deciding between a legislative priority with support from both parties and pressure from his left to resist Trump.

“We all know the level of corruption in the Trump administration is higher than any administration probably in American history,” Schumer told reporters this week. “But on stablecoins, Democrats and Republicans are talking to each other.”

Republicans need at least seven Democrats to back the stablecoin legislation, so Schumer has some leverage to force at least a floor vote on include the Trump-related language in the larger bill.

“Greenlighting Donald Trump’s corrupt stablecoin deals is wrong,” Warren said. Without a provision stopping the president’s digital token ventures, she added, the legislation “will simply facilitate Trump’s crypto corruption.”

It’s the latest hurdle for the legislation and risks undoing the fragile bipartisan coalition still negotiating the bill.

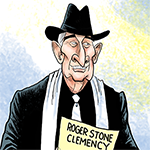

The creators of Trump’s memecoin launched a contest that offered its top holders the opportunity to win a private dinner with the president and a possible VIP tour. The move, which initially boosted sales of the token, provoked sharp condemnation from Democrats.

More than half of the top holders of memecoin appear to be foreign nationals or people who are based outside the U.S., based on the exchanges they used to purchase the memecoin.

White House Deputy Press Secretary Anna Kelly said in a statement stablecoin legislation should pass on a bipartisan basis.

“President Trump is dedicated to making America the crypto capital of the world and revolutionizing our digital financial technology,” she said. “His assets are in a trust managed by his children, and there are no conflicts of interest.”

Senator Kevin Cramer of North Dakota, a Republican member of the Banking Committee, said Trump’s crypto projects have complicated the issue politically for Democrats but defended the president’s ventures with digital tokens.

“It shouldn’t be disqualifying that you’re actually in the business world and in charge of the federal regulatory regime,” he said.

A group of crypto-friendly Democrats led by Ruben Gallego of Arizona threatened in a statement Saturday to use procedural maneuvers to block the legislation over “numerous” issues, including anti-money-laundering provisions. But that pivotal group of Democrats continues to be engaged in the talks, Republican senators said.

Republicans said they remain hopeful that they can pick off at least seven Democrats needed to overcome a filibuster against the bill.

“We have been negotiating in good faith for months,” said bill sponsor Bill Hagerty of Tennessee. “We’re ready to move.”

The stablecoin legislation is a top priority for the burgeoning cryptocurrency industry and would provide a friendly regulatory regime for the digital asset. Stablecoins, which are crypto tokens typically designed to be pegged to the value of the U.S. dollar or another traditional currency, are a lucrative business because issuers are able to invest reserves backing stablecoins in short-term U.S. Treasuries or similar products and keep the yields.

In addition to the memecoin, the Trump family’s World Liberty Financial project has issued its own stablecoin, USD1, which has a $2.1 billion market value, according to CoinGecko.

The Senate’s stablecoin bill includes a provision restating laws and ethics guidance applying to members of Congress and senior government officials, but those do not apply to the president or the vice president or their families, a Democratic aide said.

Republican Senator Cynthia Lummis of Wyoming, a sponsor of the stablecoin legislation, said senators are seeking to find language that both Democrats and Trump will accept.

Negotiators are working “to make sure that the language that we choose satisfies both Democrats and Republicans that are concerned about elected officials’ participation as issuers, but that can still be signed by the president,” she said.

World Liberty Financial announced last week the Trump-tied stablecoin was used in a $2 billion investment from Abu Dhabi’s MGX into Binance Holdings Ltd.

The transaction linked a company controlled by Trump’s family with a cryptocurrency exchange that pleaded guilty to violating anti-money laundering laws and U.S. sanctions and an investment fund overseen by Sheikh Tahnoon bin Zayed Al Nahyan, the brother of the president of the United Arab Emirates.

_____

(With assistance from Stacy-Marie Ishmael.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments