Abby McCloskey: Why giving matters, even for federal accounts

Published in Op Eds

Generosity is shocking. Especially when it’s to strangers.

That was my first thought upon hearing of the Dell family donation of $6.25 billion to fund Trump Accounts. I had other thoughts too. We’ll get to those.

But let’s start with generosity, because we don’t see enough of it anymore. The person who slips a five-dollar bill to the cashier to pay for the coffee for the person behind her. The person who remembers that the parking garage assistant could use an anonymous tip, too. A home-cooked meal on the doorstep of an elderly neighbor. It rallies the spirits — for the giver, receiver and those of us watching. It gives a sense that we’re all in this together. We lose something when giving becomes rare.

Although Giving Tuesday hit a record amount and more people participated than in 2024, the share of Americans donating to charity largely has been trending downward for the last two decades. These days, less than half of Americans give away so much as a dime.

Budgets are tight and prices high, I get that. It feels like we’re spending enough to keep our loved ones on their feet, let alone anyone else. Participation in religious organizations, wherein giving 10% is considered the philanthropic floor, has declined.

Tax changes, too, have reduced the incentive for many families to give. In their AEI report, How the 2017 Tax Law Made Itemized Charitable Giving a Luxury Good, Howard Husock and Edmund McMahon found that the middle and upper-middle class reduced charitable giving in response to the legislative changes. The law doubled the standard deduction, resulting in fewer households itemizing deductions and thus receiving far fewer tax benefits for charity. One study puts the resulting loss of charitable giving at $20 billion 2018 alone. Yet another way the middle is thinning.

Of course, there are ways to give that aren’t financial. But here, too, giving is more rare than not. Somewhere between 20 and 30% of people give their time to neighbors or to volunteer with a charitable organization, according to the Census Bureau. Many of us are providing time and care for loved ones, but there’s something more peculiar and humble about providing such tenderness to strangers also.

Up the income ladder isn’t much better. It’s true that billionaires fund a third of all charitable donations in the U.S. Philanthropic giving year-over-year is up largely because of their contributions. But levels and shares are different things; the latter is where the bite comes in, and perhaps why Biblical codes were percentages. According to a 2023 Forbes study, two-thirds of billionaires give away less than 5% of their fortune to charity. Only 11 of America’s 400 richest people have given away more than 20% of their wealth.

All of which is to say, good for the Dells. I have a feeling that more is to come. Senators Ted Cruz and Cory Booker, in a rare show of bipartisanship, sent out a letter to company CEOs encouraging them to give to children via the Trump Accounts also.

It’s no secret, even among conservatives, that wealth is increasingly becoming concentrated in our country, even more so with the coming AI boom. A wealth tax may be unconstitutional, but there’s nothing unconstitutional about the extremely wealthy giving generously to their fellow countrymen and their children.

Here we turn to the actual vehicle itself, the Trump Accounts. They are a mixed bag at best, as I’ve written in these pages before. It’s good that the money will be invested in the market; giving more people a slice of that pie, especially the next generation, connects us together.

On the other hand, with a crisis in literacy, rising child poverty and children’s health deteriorating, it would be nice to have some more support for families in the here and now. I have a sense that might be coming with an affordability reconciliation package next year, as Republicans realize they haven’t delivered the economy many were hoping for.

Others have argued that the Dells’ gift is buying political favor. And really, how could it not? As a small c-conservative, I’m no fan of presidential favoritism — picking winners and losers. I suppose the Dells could have had the money somehow deposited directly into accounts apart from the Trump-branded ones. On the other hand, it’s probably better for it to all be in one place. And there could be worse beneficiaries than young children.

Sometime in 2043, the first young adult will make a withdrawal from her account. She will take out some amount of money she wouldn’t otherwise have had, irrespective of her own parents’ ability to contribute. That’s something.

In Washington, generosity usually happens with someone else’s money. Not this time. Hopefully, it’s contagious.

_____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

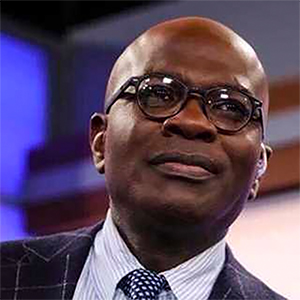

Abby McCloskey is a columnist, podcast host, and consultant. She directed domestic policy on two presidential campaigns and was director of economic policy at the American Enterprise Institute.

_____

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments