Allegiant Air to merge with Sun Country Airlines in

Published in Business News

Las Vegas-based Allegiant Air is merging with Sun Country Airlines and will form one of the largest leisure-based commercial air carriers in the country and will be headquartered in Las Vegas.

The merger agreement, approved by the boards of directors of both companies, will need shareholder approvals and clearance from federal authorities before it can be completed.

Allegiant officials believe the deal, which values Sun Country at an estimated $1.5 billion, will close by the second half of 2026.

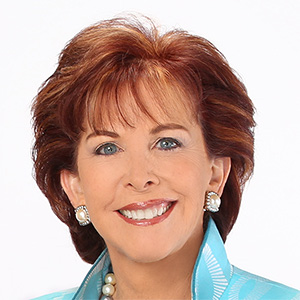

In an exclusive interview with the Review-Journal, Allegiant CEO Greg Anderson said the companies started putting details of the deal together in the fall before making the merger announcement Sunday.

“It’s a unique transaction combining two profitable and well-capitalized airlines, and that doesn’t happen too often,” Anderson said Sunday. “And we think coming together that we’ll be the clear leader in the leisure travel sector of our industry. So we think it’s just a really, really good opportunity to bring two of the strongest low-fare focus carriers together.”

Anderson admitted that it helped that he was working with Sun Country President and CEO Jude Bricker, a former Allegiant executive.

“Jude started his career here at Allegiant, and he and I have known each other for nearly 20 years, and we work closely together during his time,” Anderson said. “We feel that at our two airlines, there’s a close cultural connection. I think, as such, and with the complementary nature of our airlines that’s going to help through the integration process quite a bit.”

The combination brings together complementary route networks across Allegiant’s small and mid-sized localities and Sun Country’s larger cities and will provide more than 650 routes, including 551 Allegiant routes and 105 Sun Country routes.

The two carriers have around 22 million customers annually.

Transaction details

Under terms of the deal, Allegiant will acquire Sun Country in a cash and stock transaction at an implied value of $18.89 per Sun Country share. Sun Country shareholders will receive 0.1557 shares of Allegiant common stock and $4.10 in cash for each Sun Country share owned, representing a premium of 19.8% over Sun Country’s closing share price of $15.77 on Friday and 18.8% based on the 30-day volume-weighted average price. The transaction values Sun Country at approximately $1.5 billion, inclusive of $400 million of Sun Country’s net debt.

Upon closing, Allegiant and Sun Country shareholders will own approximately 67% and 33%, respectively, of the combined company on a fully diluted basis.

Additional details of the transaction are expected to be announced in a conference call Monday morning.

The companies said the Allegiant-Sun Country combination would maintain a major presence in Minneapolis, where Sun Country is based.

“Sun Country has very deep roots there,” Anderson said. “They’ve been there, served the community for 43 years. And so we want to continue to build on that foundation. And we’re, again, fully committed to maintaining that presence. It’ll be our largest operating base in the network.”

Bricker concurs.

“Over Sun Country’s 43-year history, we have grown to become one of the nation’s most respected low-cost, leisure airlines with a unique business model for serving scheduled service and charter passengers as well as delivering cargo, with a strong brand and deep roots in Minnesota,” Bricker said in a release announcing the transaction.

“Today marks an exciting next step in our history as we join Allegiant to create one of the leading leisure travel companies in the U.S.,” Bricker said. “We are two customer-centric organizations, deeply committed to delivering affordable travel experiences without compromising on quality. Importantly, we believe this transaction delivers significant value to Sun Country shareholders and an opportunity to continue to benefit from our growth plans as a combined company.”

New destinations

For customers, it means Allegiant will fly to several new destinations, including Mexico, Central America, Canada and the Caribbean, the combined airline will offer Allegiant customers access to expanded service from its small and mid-sized cities to 18 international destinations.

The combined airline will fly both Boeing and Airbus jets. It will have the scale to more fully utilize Allegiant’s 737 Max fleet and order book, improving fuel efficiency and capacity. On closing, the combined airline will operate approximately 195 aircraft, with 30 on order and an additional 80 options.

Sun Country has been a major narrow-body freighter operator in the U.S., with a multiyear agreement with Amazon Prime Air, as well as its charter contracts with casinos, Major League Soccer, collegiate sports teams and the Department of Defense. With the addition of Allegiant’s existing charter business, the combined airline will benefit from a further diversified business model that balances demand cycles, provides stable revenue streams and maximizes aircraft and crew utilization.

Upon closing, Anderson will serve as chief executive officer of the combined company, and Robert Neal will serve as president and chief financial officer. Bricker will join the board of directors, alongside two additional Sun Country board members, expanding the size of the Allegiant board to 11. Maury Gallagher, chairman of the board of Allegiant, will serve as chairman of the board of the combined company. Bricker will serve as an adviser to Anderson to help ensure a smooth and successful integration.

___

©2026 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments