Expect even more homebuying assistance competition after fed rule

Published in Business News

For cash-strapped, lower-income homebuyers, the housing market is a tough place to be.

And it’s only becoming more uncomfortable in 2026.

A new federal rule has changed the eligibility targets for certain down payment- and closing cost-assistance programs, which could make the application for funds more competitive. And even when those programs focused mostly on helping a smaller group of potential homebuyers, like historically underserved people of color, they were already running out of money well before the end of the year.

There are still many for-profit and nonprofit agencies that can connect prospective buyers with financial help. But applying early is the blanket advice everyone should follow.

New Year’s Day has started the clock. Here’s what entry-level buyers need to know to snag the best deal on a starter home:

Mortgage rates, though still near historical averages, have doubled in the past two years. Home prices are at record highs. And there just aren’t that many inexpensive houses for sale because people with record-low rates aren’t willing to move.

Now add to that a scant bank account and not enough cash on hand for a down payment. But there are options for anyone who needs a little help with those or just some guidance in navigating the mortgage process.

For cash-strapped buyers, down payment assistance is the most common and widely available kind of help. Typically, that comes in the form of a loan or a grant you can use to cover closing costs and other fees.

Terms of those programs vary. Some are low- or no-interest loans, while others are fully or partially forgiven after you’ve lived in the home for a certain number of years. A variety of organizations offer them, including local, county and state agencies, as well as housing nonprofits.

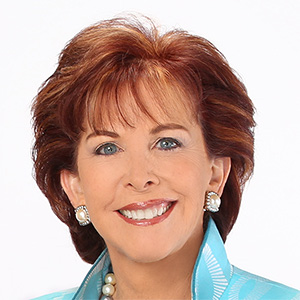

Emily Strong, the affordable product manager at Bell Bank, a Fargo, North Dakota-based institution , said there are more than 2,500 different down payment-assistance programs nationwide, though not all of them are active.

Strong was previously on the programs team at Minnesota Housing, the state’s housing finance agency, and now works in Bell’s mortgage division. She’s laser-focused on helping loan officers navigate the homebuying process with their low- and modest-income borrowers.

Buyers are often surprised to find they might qualify for a grant or loan to supplement whatever they’ve saved for a down payment. So don’t forget to ask your loan officer when you’re being pre-approved for a mortgage: “What programs might I qualify for?”

If they’re not familiar with such programs, Strong said, find someone who is.

In the past few years, lenders, with support of government policies, have ramped up their efforts to reach homebuyers who are part of an ethic or racial group with historically low homeownership rates. Many of the financial-assistance programs are geared toward people in those communities.

Earlier this year, the director of the Federal Housing Finance Agency (FHFA) announced a plan to terminate special-purpose credit programs (SPCPs), which aim to reach those underserved borrowers. Such programs also target buyers in certain areas where homeownership rates are especially low.

In part, those SPCPs meant to narrow the homeownership gap between white and Black Americans.

“These programs existed to help borrowers who had been historically discriminated against to be on equal ground with their counterparts,” Strong said. “There is a law that permitted this way of developing programs to create equality in the homeownership space. Not everybody sees it that way, which is why it’s going away.”

The mothballing of those SPCPs means lenders will no longer be able to specifically tailor programs to borrowers of certain races or ethnicities or to those in certain locations.

Strong said lenders are working on compliance efforts as they grapple with the new rules. The implications for buyers and borrowers are still unclear.

“It will sow fear (among lenders),” she said. “It’s going to drive programs underground where people don’t talk about them or advertise them. It will make lenders and communities and nonprofits think twice about how they structure or retool their programs to make it not appear as if it’s benefiting one group over another.”

Though the change will have a dramatic impact on how lenders and agencies market their programs, the potential impact on homeownership rates among low- and moderate-income homebuyers is unknown.

Strong said that, beyond federal policies, it’s also uncertain how much priority local governments will provide to homebuyer programs. Local governments are one of many sources of funding for these programs, but with commercial real estate values falling after the pandemic emptied office towers and complexes, many communities are taking in less property taxes and thus have tighter budgets to manage.

Strong said it’s critical to work with a real estate agent who is familiar with such programs.

“If you’re working with a loan officer or an agent who dismisses any of the programs as too much work or too hard, that’s a big red flag,” she said. “Work with an individual who knows what they’re doing.”

Given the uncertainty of today’s lending environment and unclear expectations about whether underwriting guidelines will loosen, Strong said it’s more important than ever to apply as early as possible in the year.

Many of these programs have limited funds and are available on a first-come, first-serve basis. Often, she said, the programs run out of money by the end of the year. In some cases, much earlier.

Strong said persistence, and working with a skilled loan officer or homebuying counselor, is the key to an affordable buying process.

“Don’t lose faith,” she said. “There are a lot of people working out there to make sure all borrowers have access to all options available. If this is your dream, you can achieve it. It just might just take awhile, given the change in federal priorities.”

©2026 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments