Judge approves $69M class action settlement in UnitedHealth 401(k) litigation

Published in Business News

A federal judge in Minneapolis said Thursday he would approve a $69 million settlement in a class action lawsuit alleging UnitedHealth Group depressed the retirement savings of workers for years by selecting poorly performing investment options in the company 401(k) plan.

The litigation alleged “the fix was in” to retain investment funds managed by California-based Wells Fargo, in order to protect UnitedHealth Group’s significant business relationship with the big bank, which was buying employee health insurance from the company’s UnitedHealthcare division.

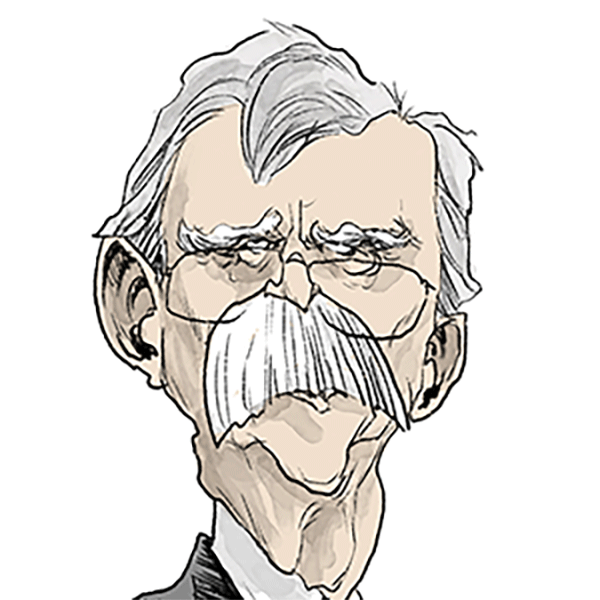

Last year, Judge John Tunheim of the U.S. District Court of Minnesota said the case could move forward after determining “a reasonable trier of fact could easily find” that Kim Snyder, the lead plaintiff in the case, caught the Eden Prairie-based company “with its hand in the cookie jar.”

UnitedHealth Group issued a statement Thursday that while it denied any allegation the company failed to act in the best interest of plan participants, “this settlement allows all parties to put this matter behind them and move on.”

The litigation unearthed a 2018 email in which Chief Financial Officer John Rex complained Wells Fargo was shifting its insurance business away from UnitedHealthcare, even though Rex had “stepped in front of a freight train” to maintain Wells Fargo as the default retirement investment fund despite recommendations from an internal committee.

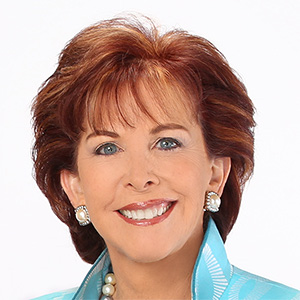

Snyder knew none of this when she first brought the case, she said in an interview following Thursday’s court hearing for final settlement approval.

After losing her job about four years ago with the company’s Optum division, Snyder reviewed her retirement savings, she said, and started questioning why the investments hadn’t grown more. A Detroit resident, Snyder, 64, is a nurse who worked remotely for Optum’s pharmacy business.

“I think they took the employees’ wealth,” Snyder said. “They took advantage of that, when [workers] were giving them money to invest … and used it for their own purposes. That was the freight train that nobody knew about.”

Wells Fargo sold off its asset management business years ago.

As of Thursday afternoon, Tunheim had not yet issued final paperwork cementing the settlement, but he said from the bench he would sign proposed orders drafted by attorneys without major changes.

The draft called for lawyers to receive one-third of the settlement fund, or $23 million, plus reimbursement of $735,162 in costs. The rest will be distributed among hundreds of thousands of retirement plan holders.

Snyder, as the sole class representative, would also receive a service award of $50,000.

The $69 million settlement represents between 20% and 25% of likely potential recovery had plaintiffs prevailed in court, said Leigh Anne St Charles, a plaintiff attorney in Nashville who represented the class.

Only two out of more than 350,000 class members filed letters of objection to the settlement. Both asked the court to consider an alternate age-weighted distribution formula for payouts, St. Charles said, even though age and length of service already are implied factors in settlement distributions.

Each class member’s proportional share will be based in part on the balance they invested in certain Wells Fargo Target Date Funds at any time since April 23, 2015, according to a website with settlement details.

A settlement notice issued in the spring said class members don’t need to do anything to receive payment.

Current plan participants will receive their share in the form of a deposit into their plan accounts. Payments to former plan participants will be made directly by check unless they elect to receive funds via rollover to a qualified retirement account.

Snyder first filed her lawsuit in 2021.

In March 2024, Tunheim denied United’s push for summary judgment in the case, citing evidence that Rex requested “balance of trade” ledgers be produced showing how much business UnitedHealth Group conducted with Wells Fargo.

On one side of the ledger, UnitedHealth generated between $50 million and $60 million in revenue over four years as health insurance provider for Wells Fargo. On the other side, Wells provided substantial banking services to UnitedHealth, which was the bank’s “largest client and lifeline” in the market for target-date funds, the judge wrote.

The comparisons showed that, among the firms, UnitedHealth’s most profitable relationship was with Wells Fargo.

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments