Congress extended US flood insurance, but the clock is already ticking again

Published in Political News

After a three-day partial federal government shutdown, Congress has reauthorized the National Flood Insurance Program until Sept. 30.

For North Carolina homeowners who rely on federally backed flood insurance, the extension offers a brief respite from disruptions in home sales and mortgage lending.

“It’s a win for housing advocates,” said National Association of Realtors Executive Vice President Shannon McGahn on Feb. 4, adding it provides the “certainty and stability that families, home buyers and the housing market need.”

But it also sets up yet another deadline that could leave thousands of high-risk properties in limbo or uninsured if lawmakers fail to act again.

NFIP has been under scrutiny for years and is currently over $22 billion in debt. Periodically, Congress must renew NFIP’s statutory authority to operate.

Groups like NAR are now pushing Congress to work on a long-term reauthorization. (Each lapse costs 40,000 property sales per month, it estimates.) They’re also calling for regulatory reforms to expand private market options.

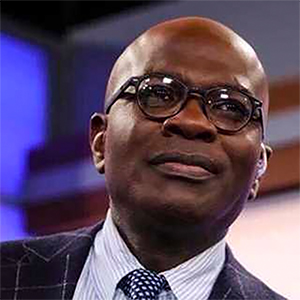

“It’s in real trouble,” NC Insurance Commissioner Mike Causey told The N&O in January. “It’s my hope that Congress resolves this issue.”

What to know

Since the late 1960s, NFIP has anchored mortgage eligibility and collateral in flood-prone areas.

Managed by the embattled Federal Emergency Management Agency, it accounts for 88% of the nation’s flood insurance. It has over 4.6 million flood insurance policies providing $1.3 trillion in coverage.

In North Carolina, the rate for flood insurance, on average, is $1,187 per year through NFIP, according to the latest LendingTree data.

In recent months, President Donald Trump has said he’d like to dismantle FEMA — and NFIP — as part of a broader plan to reduce the government’s size. Critics argue the program is unsustainable and ill‑prepared for the escalating costs of climate disasters.

But opponents warn dissolving the program could drive down property prices and collapse the real estate market.

“While private insurers may fill some gaps, coverage could become less consistent, straining household finances and complicating mortgage markets,” said First Street, a New York-based nonprofit research company in a recent report.

NFIP’s authorization has lapsed at least five times since 2018. Congress eventually restored the program through a series of short-term extensions.

Most recently, NFIP lapsed for 43 days last October, the longest pause ever recorded, following a federal government shutdown.

FEMA could not issue new policies or renew existing ones over that period. Congress later reauthorized the program retroactively through Jan. 30.

On Feb. 4, FEMA confirmed the latest extension and pushed Congress to take more drastic action.

“The level of damage from recent catastrophic storms makes it clear that FEMA needs a holistic plan to ready the nation for managing the cost of flooding under the NFIP,” it said on its website.

Separately, Causey has joined Gov. Josh Stein in urging Congress to pass bipartisan legislation that would authorize NFIP to offer pre-collapse coverage so that coastal homeowners could demolish or relocate condemned structures before they fall into the ocean.

Since 2020, 27 oceanfront houses have collapsed into the ocean on North Carolina’s Outer Banks, including 16 houses just since last September.

_____

©2026 The News & Observer. Visit at newsobserver.com. Distributed at Tribune Content Agency, LLC.

Comments