Lawmakers seek to embed financial services rules into legislation

Published in Political News

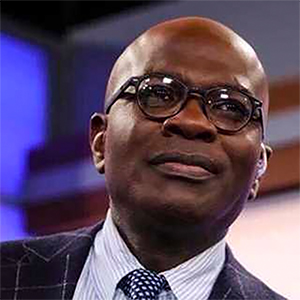

WASHINGTON — House Financial Services Chairman French Hill is on a campaign to embed financial regulations into law, a move to make it much more difficult for a different administration to reverse course.

Hill, R-Ark. has pushed the committee to approve nearly 100 bills since the start of the year. He has said he wants to take advantage of complete Republican control of government to get laws put in place.

“We’ve all experienced in our time in Congress the seesaw back and forth between administrations using executive authority or proposing rulemakings,” Hill told reporters at a briefing on Dec. 10. “And I think where you have consensus and you can put it into law and make a permanent change, society is better off. Consumers are better off. The market participants have certainty.”

One example of Hill’s approach is the package of legislation the House passed on Dec. 11 that would help boost capital for startup companies and increase the number of ordinary investors who can buy shares in them.

Several bills would direct the Securities and Exchange Commission to take actions it could have taken on its own. For instance, two bills would change the definition of an accredited investor who is eligible to buy private securities.

An investor must currently meet certain income or net worth thresholds. One bill sponsored by Hill would add criteria such as licenses and educational background; another, sponsored by Rep. Mike Flood, R-Neb., would establish qualifying exams.

Rep. Bill Huizenga, R-Mich, sponsored another bill that would allow automatic electronic delivery of certain regulatory documents, such as prospectuses and account statements.

Huizenga said he spoke to SEC Chairman Paul Atkins a couple weeks prior to the bill’s passage, and that Atkins “wholeheartedly agreed” with codifying certain regulatory moves into law.

“My message to him [was]…yes, you could do some of these things on your own, but don’t you think it’d be better if we could cement them in and lend that predictability,” Huizenga told reporters at the Dec. 10 briefing with Hill. “To calm the markets, especially in a turbulent time and in a turbulent world, in my mind, is far better, and we can help do that by driving real consensus on policy that gets cemented in through legislation” rather than just regulatory actions.

Getting ahead on crypto

Regulations are poised to get ahead of legislation in the oversight of cryptocurrencies. Although Congress passed a stablecoin bill that has been signed into law, the next iteration of crypto legislation is wider ranging and more important to the industry.

The House passed a bill sponsored by Hill over the summer that would set rules for the operation and oversight of digital assets markets. The Senate is working on its own bill.

Atkins has said on several occasions that the SEC has all the authority it needs to proceed with cryptocurrency regulations. In addition to crafting new rules, he has promised to provide exemptions for crypto market development.

But he recently acknowledged that legislation would make the changes more indelible.

“I have confidence that whatever comes out of Congress, that will bolster what we’re doing,” Atkins said at the Blockchain Association Policy Summit on Dec. 9. “What is really important to me is that we future-proof what we’re doing. Whatever happens down the road, we don’t have the pendulum swinging the other way and then having a lot of our efforts washed away.”

The American Fintech Council is advocating for a bill, also sponsored by Hill, that would establish an Office of Independent Examination Review within the Federal Financial Institutions Examination Council to review supervisory findings. It also would allow financial institutions to appeal audit and inspection results.

The Federal Deposit Insurance Corporation set up a Supervisory Appeals Review Committee in 1995 to make decisions on appeals of supervisory findings. The FDIC replaced the body in January 2021 with an independent group within the FDIC known as the Office of Supervisory Appeals. But in May 2022, the FDIC restored the SARC.

Ian P. Moloney, the American Fintech Council’s chief policy officer, wants to see the independent appeals process become a permanent part of FDIC oversight. That would require the bill to become law.

“By codifying the change, you inherently make it more durable,” Moloney said. “What we’re looking for is to ensure that settled expectations by regulatory entities are able to be maintained throughout administrations.”

As Hill put it: “I don’t think there’s anything that’s more superior to finding consensus in Congress and passing something into law.”

©2026 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments