Tariffs face legal threat that puts Trump's deficit plan at risk

Published in Political News

President Donald Trump’s most concrete step to rein in unprecedented U.S. budget deficits — sweeping tariff hikes — faces the danger of a legal reversal that would put the nation’s finances on an even shakier footing.

Trump and top aides including Treasury Secretary Scott Bessent have argued that federal borrowing needs will shrink in coming years as Republican tax cuts, reduced regulation and big-ticket investment pledges from companies and foreign nations stoke economic growth and goose federal revenues. Many economists question that outlook, but few disagree that tariff hikes are indeed generating a new stream of cash for the Treasury.

Customs duties — paid overwhelmingly by American importers — have totaled $165 billion for the 2025 fiscal year with one month left to go, Treasury Department figures showed Thursday. That’s up some $95 billion on the year before.

Most of the jump is thanks to tariffs Trump imposed using the International Emergency Economic Powers Act (IEEPA) Bloomberg Economics analysis shows. But an Aug. 29 federal appeals court ruling has called the legality of that maneuver into question. Unless the Supreme Court, which has agreed to review the case, decides in the president’s favor, Bessent has warned the government could be liable to refund large sums of money. This week, he expressed confidence the court will rule for the White House.

This year’s added tariff revenue still pales in comparison with the budget gap, which totals almost $2 trillion for the first 11 months of fiscal 2025. But a number of economists have backed Bessent’s prediction of a current run-rate of about $300 billion or more a year.

That’s effectively 1% of U.S. gross domestic product. And at a time when the deficit has been exceeding 6% of GDP, it’s enough to make significant progress over the coming decade toward Bessent’s ultimate goal of shortfalls near 3%. Wipe that away, and bond investors and economists are left with little more than hopeful projections for growth and productivity to temper U.S. borrowing requirements.

“It’s just a wild card that you’re going to have to deal with when the time comes,” said Lou Crandall, chief economist at Wrightson ICAP, who’s been analyzing Treasury debt strategy since the 1980s. “If the court case goes against the Treasury and the administration doesn’t want to see the deficit continue to rise, there are going to be policy responses of some sort — we just don’t know what they are.”

For now, bond investors are more focused on prospects for Federal Reserve interest-rate cuts, with yields on both short-dated and longer-term securities falling this month. Also, there’s the likelihood of Trump’s team reconstituting much of the tariff framework using other executive authorities, including measures known as Sections 232 and 301.

‘Infuriating thing’

“We think bond markets should shrug off the one-time cost of tariff refunds, and we still fully expect that Trump will recreate the tariffs prospectively through other authorities if he loses in court,” Tobin Marcus, head of U.S. policy and politics at Wolfe Research, wrote in a note to clients.

Bessent, speaking on Fox Business Tuesday, described the tariff fallback plan as “more cumbersome, and I think it limits the president’s hands.”

It also would mean a further revamp of duties that have already been fluctuating. The uncertainty threatens to impose costs on individual businesses and the broader economy. Slower growth and a weakening labor market could also push up spending and reduce revenues, further widening the budget gap.

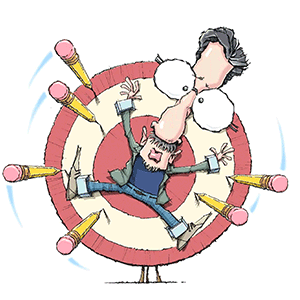

Elana Ruffman, a marketing executive at Vernon Hills, Illinois-based hand2mind Inc., which makes educational toys, has been among those frustrated by shifts in U.S. duties.

“It’s the most infuriating thing,” she said, describing the experience her family-owned firm and its sister company Learning Resources Inc. have been going through this year.

After Trump slapped tariffs well in excess of 100% on China in April, the company awarded a product line to a factory in India — which administration officials had been indicating was likely to get a deal with Washington. It planned a new line of kids’ yoga and mindfulness products for a Christmas debut, and the items needed to ship in August.

“We called in every favor we had” in the effort to shift out of China, get safety tests done and go into production in India, Ruffman said. “All to come in at a higher tariff than it would have if we’d kept it in China” she said — referring to how the president last month jacked up the U.S. surtax on Indian imports to 50%. Meantime, the added levy on goods from China has come down to 30%.

So far this year, Ruffman said her company has paid more than $5.5 million in tariffs, compared with just $2.3 million for all of 2024. And the bill would be much higher if the company hadn’t paused production on many of their goods to avoid significant price hikes, Ruffman said.

Her company was among those to sue the Trump administration over its invocation of IEEPA to impose tariffs, with the case now awaiting Supreme Court review.

Debt trajectory

The Yale Budget Lab estimates that, if the IEEPA tariffs in question are invalidated, that would remove about $1.5 trillion of revenues over a decade, leaving the remaining levies collecting $496 billion.

While many economists now see the U.S. as likely to be collecting substantially more revenue than previously assumed over the longer haul, any Supreme Court ruling invalidating a slice of them and requiring a slew of refund checks risks reminding bond investors of the broader fiscal path.

The nonpartisan Congressional Budget Office earlier this year warned that the U.S. was on a path to surpass record debt levels set after World War II in 2029 — in a set of assumptions that included the expiration of a swath of Trump’s tax cuts by the end of 2025.

While Trump’s latest tax legislation, enacted in July, provides even more tax benefits, his tariffs were seen as restraining the increase in borrowing. S&P Global Ratings last month cited the new tariff revenue trajectory in affirming its AA+ sovereign-debt rating for the U.S.

“Markets may become nervous that a significantly large refund could weigh on Treasury’s finances, especially given recent comments by several rating agencies that tariff collections benefit the longer-term U.S. debt trajectory,” TD Securities strategists led by Gennadiy Goldberg wrote in a Sept. 4 note to clients.

———

(With assistance from Enda Curran, Jarrell Dillard and Sophie Butcher.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments