Crypto, Defense bills back on track after Oval Office talk

Published in Political News

WASHINGTON — Three pieces of cryptocurrency legislation and the fiscal 2026 Defense appropriations bill appeared ready for House floor action on Wednesday after stalling out for much of the day on Tuesday.

After a group of conservative Republican lawmakers sank the rule for floor debate over objections to how the crypto bills were being sent to the floor, GOP leaders initially were forced to pull the rule and scrap votes for the rest of the day. But most of the dozen defectors on the vote apparently had changes of heart after personal intervention from President Donald Trump in the Oval Office late Tuesday.

In a statement posted Tuesday night on his social platform Truth Social, Trump said he was meeting with 11 of the 12 rule opponents from earlier in the day — the 13th, House Majority Leader Steve Scalise, R-La., voted “no” as a procedural mechanism so he could call the rule back up later.

“[A]fter a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule,” Trump wrote, adding that Speaker Mike Johnson, R-La., dialed in to the meeting by phone. “I want to thank the Congressmen/women for their quick and positive response. MAKE AMERICA GREAT AGAIN!” Trump added.

Earlier, the GOP defectors joined with the Democrats to defeat the rule on a 196-223 vote. The rule would set the terms of floor debate for a Senate bill that would establish regulations for stablecoins, which if cleared by the House would go to Trump’s desk for his signature. A provision in the rule to prevent the bill from being amended particularly raised the ire of some House Republicans.

The rule also covers debate for a bill to set rules for offering, trading and overseeing digital assets, known as market structure; legislation that would prohibit the Federal Reserve from issuing a central bank digital currency; and the Defense spending bill.

Several members of the House Freedom Caucus said the Senate stablecoin bill would allow for a central bank digital currency.

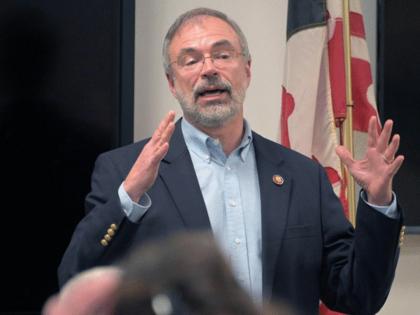

“A group of people, including the House Freedom Caucus, believes that central bank digital currency — we have to put a stake in its heart once and for all, and the action under that rule wouldn’t have done it,” Freedom Caucus Chairman Andy Harris, R-Md., said after the vote.

Republican leaders huddled to try to find a way through the impasse, amid expectations that they would return for another floor vote at the end of the afternoon with a solution. But the House adjourned without a vote announcement, leaving the Defense spending bill in limbo along with the crypto bills.

“It’s a priority of the White House, the Senate and the House to do all of the crypto bills,” Johnson told reporters as he left his office late Tuesday afternoon after huddling with other members to work out a way forward on the rule. “But we’ve got to do them in succession.”

That appeared to be a reference to the push by some GOP resisters to combine the crypto bills. But adding other crypto measures to the Senate stablecoin bill would force the Senate to vote again on it and slow the process of getting it to the president.

Trump demanded last month that the House take up the bill quickly after the Senate passed the legislation. Enacting the bill, dubbed the “GENIUS Act” by its authors, would deliver a major victory for the crypto industry and bolster Trump’s goal of making the U.S. a leader in digital assets.

But Trump told a reporter Tuesday that he wasn’t disappointed with the result on the rule. “No. The interesting thing was the 12 votes were votes where they wanted it to be stronger in terms of crypto people,” he was quoted as saying.

Harris along with Reps. Andy Biggs of Arizona; Tim Burchett of Tennessee; Michael Cloud of Texas; Andrew Clyde of Georgia; Eli Crane of Arizona; Marjorie Taylor Greene of Georgia; Anna Paulina Luna of Florida; Scott Perry of Pennsylvania; Chip Roy of Texas; Keith Self of Texas; and Victoria Spartz of Indiana opposed the rule.

“I just voted NO on the Rule for the GENIUS Act because it does not include a ban on Central Bank Digital Currency and because Speaker Johnson did not allow us to submit amendment to the GENIUS Act,” Greene wrote on the social media platform X. “Americans do not want a government-controlled Central Bank Digital Currency.”

An executive at Coinbase, the largest cryptocurrency exchange in the United States, said he hoped Congress would vote on the crypto bills as soon as possible.

“Legislation is hard,” Faryar Shirzad, Coinbase’s chief policy officer, posted on X. “With every step forward, there is inevitably a step back. The necessary procedural vote on the crypto bills failed this afternoon, but leadership is working on getting it up for a vote and passed as soon as possible. It’s in these moments we’ll see who is trying to get pro-crypto legislation done and who is not.”

Some House members acknowledged resentment toward the Senate over that chamber’s insistence that the House clear Senate-passed legislation as is. The House cleared the Senate’s version of the reconciliation bill, and a similar scenario could play out with pending rescissions legislation.

“The House is kind of used to not really being given any deference when we send things to the Senate,” Rep. Warren Davidson, R-Ohio, told reporters. “So, there are people frustrated with that. Some of it is just an anti-take-whatever the-Senate-sends-you-and-do-it sentiment, too.”

The House Financial Services Committee approved its own stablecoin bill in April but set it aside to advance the Senate stablecoin bill.

House Agriculture Chairman Glenn “GT” Thompson, R-Pa., said there is some tension between the House and Senate.

“I get the sense that part of that is just because of not having a lot of faith in the Senate moving our legislation,” Thompson told reporters. “I have complete confidence. I have the privilege of working with Sen. Scott and Sen. Boozman, both former colleagues and close friends, and they’ve made a commitment to deliver” on the digital asset market structure bill.

Thompson was referring to Senate Banking Chair Tim Scott, R-S.C., and Senate Agriculture Chair John Boozman, R-Ark.

The financial and agriculture committees of the House and Senate must work together on the market structure bill because it would sort out regulatory jurisdiction over cryptocurrencies between the Securities and Exchange Commission and the Commodity Futures Trading Commission. Senate Banking and House Financial Services oversee the SEC, while the agriculture panels oversee the CFTC.

______

(Aidan Quigley and John T. Bennett contributed to this report.)

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments