POINT: Until we raise the minimum wage, tip!

Published in Op Eds

Our nation’s paltry federal minimum wage of just $7.25 hourly is rightly criticized as far too little to sustain a worker, let alone a family, in 2025.

That’s bad enough, but did you know that there’s an even lower floor for workers who receive tips on the job? That’s right. The federal minimum wage for tipped workers is just $2.13 an hour — and has been for 30 years.

Theoretically, employers are meant to cover the difference if tips don’t raise hourly wages to the federal minimum. Cases of bosses failing to meet that requirement are commonplace.

Eight states have eliminated this tipped minimum, ensuring that tipped workers receive the same minimum as others. In the other 42 states, bartenders, servers and hotel workers are constantly exposed to wage theft.

Not only do tipped workers often end up making less than the minimum wage, but their lower floor also makes their livelihoods dependent on external factors, such as weather and customer traffic. It also exposes them to customer harassment, a massive issue for two-thirds of servers who are women.

“Many of my coworkers and I are pressured to tolerate inappropriate customer behavior because our livelihood depends on being likable,” said Red Schomburg, a One Fair Wage campaigner who worked as a bartender in Boston. “This especially harms women and contributes to the restaurant industry’s notoriously high rates of harassment.”

With that in mind, we can’t just stop tipping. Because the sub-minimum wage has been decoupled from the federal floor since 1996, businesses and policymakers have essentially shifted the responsibility of ensuring tipped workers earn enough to make ends meet to consumers.

We need to eliminate the tipped minimum and establish one fair wage for all workers. One that’s far, far above $7.25 an hour. Until then? Tip.

Raising tipped minimums to the same level as other workers has been successful when it has been tried. Despite complaints from industry groups, restaurants and server jobs have boomed since the District of Columbia began increasing the wage floor for tipped workers.

This has not been the approach of our federal government. Instead, lawmakers have toyed with the margins of the real issue of insufficient pay.

During the 2024 presidential campaign, Donald Trump proposed exempting tips from federal taxes. And now a similar policy, allowing for tips to be deducted from taxes, was slipped into the Republican “Big Beautiful Bill.”

At first, that sounds like a pro-worker policy. But looking past the surface reveals a policy that would help Wall Street executives more than servers.

Many tipped workers in America — two-thirds, by one measure!— don’t earn enough to have to pay federal payroll taxes in the first place. On the other end of the spectrum, some experts have warned that hedge fund managers or lawyers would likely reclassify some of their incomes as tips to avoid taxes.

Removing taxes on tips would alleviate pressures to raise tipped minimum wages and encourage more industries to treat their employees as tipped workers. No wonder the National Restaurant Association, which has long opposed wage increases for servers, has endorsed this policy.

Admittedly, there are many other places where tipping has become the norm, but employees do not receive sub-minimum wages, such as in coffee shops. While frustration with paying an extra buck or two on top of an already expensive latte is understandable, focusing on tipping is misguided.

Instead, we should wonder why workers at global chains need tips to meet their basic needs despite working full-time jobs.

The solution to both problems is the same: Pay people family-sustaining wages, wages they deserve, and no one will have to complain about onerous tips ever again.

_____

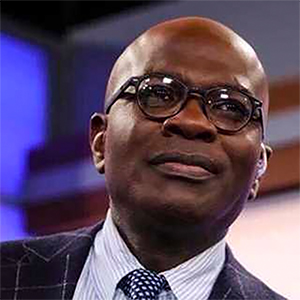

ABOUT THE WRITER

Chris Mills Rodrigo is the managing editor of Inequality.org at the Institute for Policy Studies. He wrote this for InsideSources.com.

_____

©2025 Tribune Content Agency, LLC

Comments