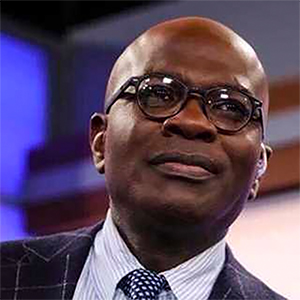

Allison Schrager: America's debt problem is also a retirement problem

Published in Op Eds

The wise minds at Moody’s Investors Service finally acknowledged last week what the other two main credit rating agencies did years ago: America has a debt problem. Now it’s time for America to recognize that solving its debt problem will require addressing another hard truth: Americans have a retirement problem — specifically, they retire too soon.

Despite reports that Moody’s decision is related to the fiscal impact of the $3.7 trillion tax legislation the House is currently debating, that bill is just the proverbial rearranging of deck chairs on the Titanic. The biggest source of America’s long-term debt problem, which is not even included in the 10-year budget projections, is unfunded entitlements, largely Social Security and Medicare.

For some reason it has become considered politically wise for both Republicans and Democrats to promise they “won’t touch” Social Security. This is not realistic. Within the next 10 years, the program won’t be able to pay full benefits. Something has to change, and that something is the retirement age. Americans like to make fun on the French for their early retirements, but many Americans also retire in their early 60s. In many states, retiring at 62 is the norm.

Since the reform of Social Security in the 1980s, the “normal retirement age” — that is, the age at which people qualify for full benefits — has been creeping up from 65 to 67, depending on when they were born. There are further financial incentives to delaying retirement until age 70. Because of these enticements, and the longer and healthier lifespans for many Americans, the average retirement age has also started to creep up.

But most Americans do not take advantage of later retirement. Social Security’s early retirement age, 62, remains unchanged, and there are no concrete plans to increase it. More than one-third of Americans, and nearly 40% of women, retire early.

This is not entirely by choice. Age discrimination is real; someone who loses their job after age 60 can find it very hard to get another one. Some people also have physically demanding jobs they can’t do into their 60s.

Still, organizing the retirement system around a minority of the population doesn’t make sense. Just because some people can’t work at age 62 doesn’t mean the option of retiring at that age should be available to everyone. Those who need to retire early can be better served by Social Security’s existing disability program. For everyone else, the early retirement age should be gradually increased to 65 over the next decade. More can also be done to make older workers more appealing to employers, especially around health benefits, since most older workers qualify for Medicare.

Of course, raising the early retirement will not by itself close the entire Social Security funding gap. If it were increased and then indexed to life expectancy (and the normal retirement age was as well), and depending on the details, then the long term-shortfall would be reduced by anywhere between 14% and 50%.

Raising the early retirement age would also be regressive, because richer people tend to live longer, while early retirement is more common in low-income states. That’s why an increase in the early retirement age should be paired with a 2.5% payroll tax increase on earnings about $250,000. That would be more realistic, equitable and fiscally responsible than promising higher taxes on just the wealthy, or opting just to run bigger deficits.

It is tempting to dismiss the Moody’s downgrade as non-news. The debt problem isn’t new, and the ratings agencies have lost a lot of credibility in recent decades. But it is an opportunity for an honest politician to level with the American people. The country’s debt problem is bigger than the latest budget or tax bill; it starts and ends with entitlements. And addressing that problem will require Americans not only to pay more taxes, but also to retire later in life.

____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of “An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.”

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments