COUNTERPOINT: States should refuse to make risky bets on crypto

Published in Op Eds

States should think twice before creating state strategic crypto reserves before following New Hampshire’s lead. That state’s lawmakers have placed a dubious bet using public funds on a shady and risky product. If they lose, so will taxpayers and others.

The crypto industry’s massive political spending in 2024 has bought many politicians willing to agree to whatever light-touch regulations they seek. This has sparked interest in crypto among some investors, who see all this as a green light to invest in crypto’s vaunted claims of innovation.

However, the industry’s systemic problems that caused the 2022 crypto market crash, wiping out $2 trillion in investor funds, are still present. Fraud, double-dealing, backroom deals, risky loans, poor management, money laundering, daily hacks and other problems are the rule in crypto markets, not the exception.

For example, studies suggest most people have lost money on their crypto investments. Many of the tens of thousands of crypto tokens introduced annually go to “zero” in value. Crypto markets are full of fake trading — as much as 70 percent — orchestrated by insiders to boost tokens or prices artificially and cheat unsuspecting investors. Last year, consumers reported $9.3 billion in losses due to crypto-related financial crime to the FBI — a 100% increase from the previous year, but still likely a significant undercount, given many financial crime victims fail to report out of shame.

Given this, why would anyone suggest it’s wise to use public funds to set aside crypto assets as “reserves”? It’s like stockpiling poker chips and hoping whoever’s gambling with them wins big.

The main argument for a crypto reserve is that the numbers, allegedly, will go up. Big crypto assets like Bitcoin are said to appreciate over time, which boosters claim makes them a hedge against inflation or market turmoil.

However, the data disputes such claims: crypto prices, including Bitcoin, tend to correlate with traditional financial markets. Many crypto assets are highly volatile, dropping in value dramatically with little warning, not to mention all the fraud. How does all that risk square with governments’ responsibility to manage public funds prudently, for the long term? The answer is it doesn’t.

The reserve idea has caught on is that, despite hype about crypto markets booming, trading activity is still relatively low; most people are still wary of crypto. For big crypto investors (called “whales”) sitting on big piles of Bitcoin, this means that, while they might be rich on paper, they can’t sell. Doing so with low demand would flood the market, depressing prices and devaluing their holdings. If state governments become guaranteed buyers, these big whales overnight have a great way to cash out. Good for them, perhaps, but I doubt it’s good for the rest of us.

Ironically, the mostly conservative voices pushing for a crypto reserve have historically hated similar ideas. These voices have criticized programs like the Strategic Petroleum Reserve, arguing that they interfere with the free market. At least with a petroleum or grain reserve, you are stockpiling something useful. Even after 15 years, finding real-use cases for crypto beyond speculative gambling and illicit finance is hard.

Despite crypto’s deep-seated problems, the industry’s aggressive influence-peddling, promotion and risky products will likely create another bubble that bursts, harming more people this time. States should resist the crypto fear of missing out, be responsible stewards of public funds, and decline to make risky bets on crypto.

_____

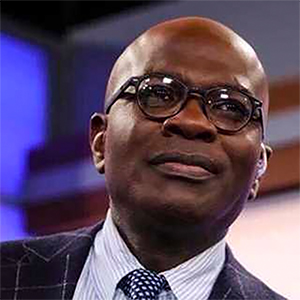

ABOUT THE WRITER

Mark Hays is associate director for crypto and fintech at Americans for Financial Reform. He wrote this for InsideSources.com.

_____

©2025 Tribune Content Agency, LLC

Comments