We weighed in on a reader’s positive experience selling by owner

Reader comment: I recently read your column in the Chicago Tribune, and I’d like to share my experience of selling my home on my own.

I had an appraiser come to my home. He was hired by the buyer’s mortgage company. I’m 65, and have lived in my home my whole life. The appraiser was older and very familiar with my neighborhood. He even knew about the changes to the local school and had intimate knowledge of the community.

Most importantly, he knew that living east of the train tracks was a major drawback for homeowners of comparable homes similar to mine. Our location was why we were selling for $20,000 to $30,000 more than those comparable homes.

Conversely, one agent called me and claimed to be “local.” She was in a suburb 15 miles away. When I took her to task about it, she abruptly hung up. In the end, it didn’t matter. The appraiser knew that I had not overpriced my home. Zillow and Redfin had consistently claimed that my home was worth about $20,000 more than my selling price, but I felt that my home was fairly priced. The buyer’s mortgage was approved, and my young, ecstatic buyer has enjoyed living there since we closed this past summer.

Had I gone with a listing agent that had suggested I make some updates and repairs, the home would have been listed for around $25,000 more than I sold it for. That higher price would have required the buyer to have a higher loan amount, and I would have needed to pay an agent around $20,000 as a commission. Glad I did it myself!

Ilyce and Sam respond: Thanks for sharing your story, and we’re delighted it had a happy ending.

We’ve often written about people who are “FSBOs” — that is, they offer their home “for sale by owner,” and sell without an agent. We suspect you’re referring to a column we wrote on whether you should hire an appraiser or real estate agent to determine the value of your home. In that column we compared and contrasted using appraisers and real estate agents.

It appears that you made the decision yourself on how to price your home for sale, and then confirmed your pricing decision with an appraiser. Often, sellers will just look at Zillow and decide they should list their home at the highest price without taking into consideration the size, updates, or location of the property.

You appear to understand your home’s location relative to other homes in the area, the things in your home that likely needed repairing, and what it would cost you to hire a real estate agent to help you sell your home. Condition issues should directly impact your list price. Deciding to sell on your own allowed you to price your home more reasonably, since you didn’t need to pay a commission.

Here’s what stuck out to us from your letter: you weren’t greedy. Often, we encounter sellers selling on their own that want every last penny they can suck out of their property. They misjudge the market, overprice their homes and end up losing out. We’ve observed that overpriced homes tend to languish on the market. When a home is listed for a long time, buyers tend to suspect that something is wrong with the property. Buyers will leap to the worst-case scenario, which usually involves some sort of awful condition issue. That impression can greatly affect what the homeowner ends up getting from the sale of the home.

Finally, it’s good that the appraiser that came to your home was very knowledgeable about your home and neighborhood. We would have loved to have heard what the appraiser thought your home was worth without the benefit of having seen the sales price you agreed to for the sale of the home. Maybe it would have been the same as your list price; maybe more.

We’re curious why more sellers, in what is arguably the hottest sellers’ market in history, don’t try to sell by owner. The National Association of Realtors, in their latest Profile of Home Buyers and Sellers, stated that only about 7% of sellers sell by owner. With so few homes available, it would seem that more sellers would test the “FSBO” waters before hiring an agent for 2%, 3% or 4% of the sales price.

========

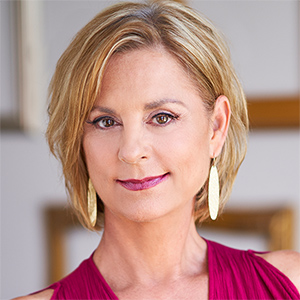

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2025 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments