Kraft Heinz pauses split to focus on what's 'fixable,' new CEO says

Published in Business News

Kraft Heinz is hitting pause on its divorce and pumping $600 million into fixing the marriage of the two iconic packaged food brands that merged in 2015.

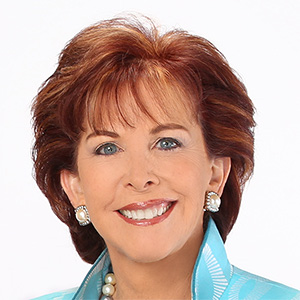

The company, which is co-headquartered in Pittsburgh and Chicago, is six weeks into the tenure of its new CEO, Steve Cahillane, who announced on Wednesday that Kraft Heinz's problems are fixable if it works to lower product prices, invests more into marketing and R&D, and postpones the planned split the company said it would pursue in September.

"As I have examined the business, I clearly see how much is fixable and how much is within our own control," Mr. Cahillane, who led the former Kellogg Co., said on Wednesday.

"It is clear that we have historically underinvested in our brands and in the business, resulting in persistent share loss over the last decade," he said in prepared remarks. "We acknowledge that our current teams are too lean, and this is limiting our ability to execute consistently."

The past year has been a tough one for Kraft Heinz, driven in large part by a decline in its North American product sales.

The company reported a net loss of $5.8 billion, or $4.93 per share, for 2025, a 313% drop from its 2024 net income of $2.7 billion, or $ 2.26 per share.

And things have only gotten worse during the past quarter, since the company told investors it would work to divvy up its brands into two separate companies by the end of 2026.

"Consumer sentiment has worsened, industry trends have softened, and there is increasing volatility in the geopolitical landscape," Mr. Cahillane said.

Instead of focusing on a split that would have concentrated brands like Kraft Singles, Oneida and Maxwell House into a North American business and premium labels like Heinz, Philadelphia and Kraft Mac & Cheese into a globally focused entity, Kraft Heinz will instead turn its efforts into a companywide turnaround.

The $600 million slated for investment will be concentrated mostly in the U.S., supporting lower prices, smaller packages, better marketing and a 20% increase in R&D spending.

"In this cycle we've been through over the last couple of years, prices were not earned," Mr. Cahillane said during an earnings call Wednesday morning. The company raised prices because of inflation costs but did not deliver "incremental benefits" to consumers with those higher prices.

"We need to earn our price by providing consumers with more value and product differentiation," he said.

He said he was excited about the launch of a new Kraft Mac & Cheese product called PowerMac, a protein and fiber-rich version of the classic box arriving on shelves in the second quarter, and single-serve bottles of Capri Sun.

Mr. Cahillane also touted the company's new ranch formula, offered with a money-back guarantee and also sold in smaller bottles for a lower price. Mustard, "with its clean nutritional profile," is being nudged for dressings and marinades.

Consumer dollars will have to stretch further in 2026, with reductions in benefits from the Supplemental Nutrition Assistance Program, company leaders said. About 13% of Kraft Heinz's sales in the U.S. come through SNAP purchases, CFO Andre Maciel said, which is a bit higher than the industry average.

So reductions in benefits, which are a result of the One Big Beautiful Bill narrowing eligibility for federal food assistance, are expected to hit the company hard.

"The consumer that's under the most pressure is having money removed from their household budget," Mr. Cahillane said during the company's earnings call. "But it also presents an opportunity for us to compete for that consumer, with opening price points, with small pack sizes."

Mr. Maciel said that Kraft Heinz plans to have lower entry prices across about 40% of Kraft Heinz's product categories.

Wednesday's news comes less than a month after Berkshire Hathaway, the conglomerate that brought Kraft and Heinz together in 2015 and remains by far its largest shareholder, disclosed it may seek to sell all of its holdings in the company.

Berkshire's founder, Warren Buffett, who retired on Jan. 1, had previously criticized the plan to split up Kraft Heinz, telling CNBC in September that "it certainly didn't turn out to be a brilliant idea to put them together, but I don't think taking them apart will fix it."

It was expected to cost some $300 million to effectuate the separation plan. Mr. Cahillane said Wednesday there is no time limit for the pause and that the company would re-evaluate its options once it's on steadier ground.

©2026 PG Publishing Co. Visit at post-gazette.com. Distributed by Tribune Content Agency, LLC.

Comments