Nevadans have a lot of credit card debt. How would a cap on interest rates impact that?

Published in Business News

Nevada has one of the highest rates of credit card debt in the country, according to a new study as the issue takes center stage during an election year.

A new Wallet Hub study found that Nevada households have the 5th highest rate of credit card debt in the country with an average of $12,832 and the state has approximately $13.7 billion in credit card debt.

President Donald Trump’s recent statement that he wants credit card interest rates capped at 10 percent drew mixed reactions from economic analysts who say the move may have unintended consequences. However, they applauded his push to highlight what is a growing issue across the country.

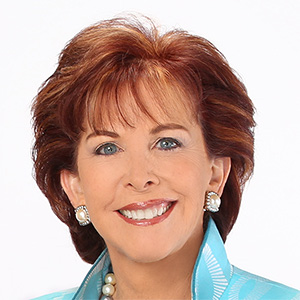

Assemblymember Lisa Cole, a Republican from District 4 in Clark County, said she applauds Trump for bringing light to a serious issue but said anytime a cap is put on something in a free market capitalist system, it can have unknown and unintended consequences. She said offering cheaper credit may also spur more Americans to take on more debt.

Cole added the “viscous circle” of credit card debt and delinquencies is definitely something that needs to be taken seriously when looking at the overall health of the U.S. economy.

“It’s scary to know there are so many people out there with credit card debt that might not get paid back,” she said. “It compounds on itself because if you’re not paying it off at the end of every month and you have a super high interest rate just compounding and compounding, what ends up happening at the end of the day is the the person has to seek bankruptcy protection from their creditors. And then you have the creditors out of their money and so then they want to charge more interest to get that back from other people.”

Affordability looks to become a central issue for the 2026 midterm elections as Trump has made a number of policy statements recently, including banning large institutional investors from the housing market and directing the government to buy $200 billion worth of mortgage bonds with the goal of lowering mortgage rates that have been stubbornly high since the tail end of the pandemic.

The most likely unintended consequence of capping credit card debt is decreased consumer spending, said Stephen Miller, the research director at UNLV’s Center for Business and Economic Research. He said banks make a lot of money on compounding interest from people who don’t pay off their credit cards each month, and he pointed out that one of the things keeping the American economy afloat right now is consumer spending.

According to the Federal Reserve, consumer spending makes up approximately 67 percent of U.S. GDP.

“If Washington passed legislation to cap credit card rates at 10%, that would be very popular among people, they would like that,” Miller said. “The problem is, some banks would stop issuing credit cards because they’re not going to make money, they are going to lose money. So the downside is the amount of credit card debt would be reduced and that would reduce consumption and have effects on GDP.”

Credit card debt across the country is at an all-time high, according to the Federal Reserve, sitting at $1.2 trillion and estimates are the average American currently has approximately $6,500 in credit card debt.

Credit card debt levels are now well above pre-2008 levels right before the Great Recession, according to a new report from the Federal Reserve Bank of St. Louis. The report noted Americans are defaulting on credit cards at an alarming rate.

“The present share of credit card debt in delinquency is reaching levels seen in the 2008 global financial crisis, and the share of people in delinquency has surpassed levels from that time,” reads the report. “This is surprising, given that the labor market is significantly stronger than it was during the financial crisis.”

Matt Hennessy, a local mortgage advisor, said he sees a lot of similarities between the lead up to the Great Recession regarding mortgages and current credit card debt. He said at their core, both mortgage and credit card lending use the same fundamental principle, which is risk-based pricing. This means borrowers who present more risk pay more for access to credit, while lower-risk borrowers are rewarded with better terms.

He said capping credit card interest rates at 10% sounds like a “no brainer” and that lower interest rates on credit cards is definitely something the economy should strive towards, however in reality it could set off a chain reaction much like the mortgage industry saw before 2008. He said banks would be forced to decrease their exposure to more riskier clients.

“If a government mandate forces banks to charge no more than 10% on credit cards, the pricing lever disappears,” he said. “When lenders can’t price for risk, they must control risk another way. That usually means lower credit limits, fewer approvals, stricter underwriting criteria, exclusion of higher-risk borrowers altogether.”

Hennessy said the unintended consequences of capping credit card rates would start with well-qualified borrowers keeping their credit cards and enjoying significant interest rate cuts from 28 to 30% down to 10%, saving real money short-term. But banks facing profit squeezes can’t just absorb losses from high-risk accounts he said, they must adapt as they are still running a business.

“Next comes the credit tightening,” he added. “Banks raise minimum credit score requirements, slash credit limits on existing less than perfect credit borrowers like the 60 to 75% cuts seen in 2008. This creates a micro-credit crunch at the household level, hitting paycheck-to-paycheck families who rely on cards for liquidity and emergency backstops.”

Then there would be a spillover effect, said Hennessy, as reduced limits would spike credit utilization ratios, tanking FICO scores.

“This raises costs or overall approvals for auto loans, personal loans, and mortgages for my clients, directly undermining the goal of freeing up cash for home down payments,” he said. “With reduced access to traditional credit, worse alternatives emerge. Vulnerable borrowers shift to payday loans or buy-now-pay-later schemes with effective rates that oftentimes far exceed the proposed cap of 10%.”

Hennessy said the economic impact would be a rapid tightening amplifying a slowdown as seen in 2008 when access to credit deepened the recession by curbing spending and month over month liquidity for lower-income households.

Hector Amendola, the president of Las Vegas-based Panorama Mortgage Group said he doesn’t think credit card debt would create the same type of risk that occurred in 2008 as it’s unsecured and isolated, however still thinks it could be a massive, more slow moving problem for the overall economy down the road.

“The real story is worse in a different way,” he said. “This isn’t a crisis that will blow up the economy in 18 months. It’s a slow-motion wealth transfer that’s already locked millions of people out of homeownership permanently. When the median first-time buyer is 40 years old, you’re watching an entire generation lose 10 plus years of equity growth they’ll never recover. The credit card crisis can quietly destroy generational wealth for many.”

_____

©2026 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments